🔍 Gold Prices Retreat After Record Highs — Healthy Correction or Trend Reversal?

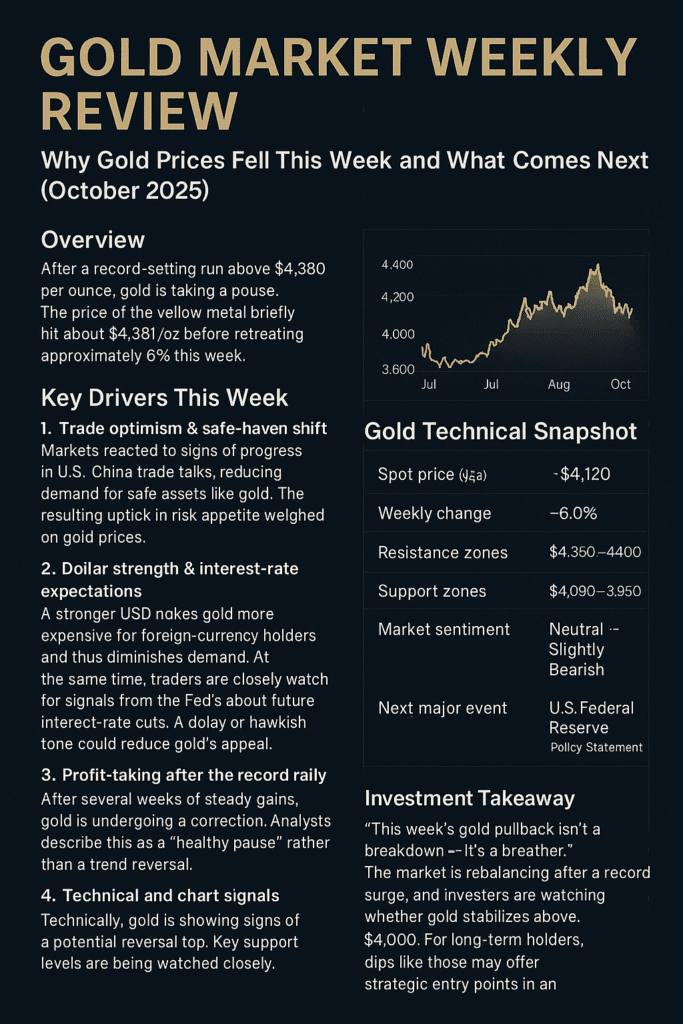

After an impressive rally to record highs, gold is taking a pause. The price of the yellow metal briefly hit about $4,381/ozbefore retreating approximately 6% this week. The Times of India+4TechStock²+4FXEmpire+4

The pull-back reflects profit‐taking, a firmer US dollar and growing optimism around a potential trade deal between the United States and China — which tends to weaken gold’s safe-haven appeal. The Times of India+3Reuters+3FXStreet+3

Key Drivers This Week

1. Trade optimism & safe-haven shift

Markets reacted to signs of progress in U.S.–China trade talks, reducing demand for safe assets like gold. The resulting uptick in risk appetite weighed on gold prices. Reuters+1

2. Dollar strength & interest‐rate expectations

A stronger USD makes gold more expensive for foreign-currency holders and thus diminishes demand. At the same time, traders are closely watching for signals from the Federal Reserve (Fed) about future interest-rate cuts. A delay or hawkish tone could reduce gold’s appeal. FXEmpire+2The Economic Times+2

3. Profit‐taking after the record rally

After several weeks of steady gains, gold is undergoing a correction. Analysts describe this as a “healthy pause” rather than a trend reversal. Kitco+1

4. Technical and chart signals

Technically, gold is showing signs of a potential reversal top. Key support levels are being watched closely, and if broken could lead to deeper correction. FXEmpire+2RoboForex+2

Key Levels & What to Watch

- Resistance: ~ $4,351/oz and potentially toward $4,400–$4,450 if momentum returns. RoboForex+1

- Support: ~$4,030/oz is first key zone; below that ~$3,960–$3,940/oz could be next target. RoboForex+2FOREX24.PRO+2

- Outlook: If gold holds above support and global uncertainty resurfaces (inflation, geopolitical risk, central-bank buying), another leg higher is possible. Conversely, a stronger dollar and easing risk could press gold lower.

Investment & Market Implications

- For long-term investors: The broader outlook for gold remains relatively bullish thanks to persistent inflation concerns, central-bank buying and currency devaluation risk. ABC+1

- For short-term traders: With the recent pull-back, a “sell on rise” strategy is being suggested until clearer momentum emerges. The Economic Times+1

- Portfolio note: Gold’s role as a hedge may be temporarily diminished while risk-appetite returns and safe-haven flows ease. But the metal remains an important diversification tool.

Conclusion

Gold had a spectacular run, but this week saw a natural correction amid improving trade sentiment and dollar strength. While the short-term picture is cloudy, the long-term fundamentals remain intact. Investors should keep a close eye on the Fed’s next moves, the U.S.–China trade dialogue, and key technical support zones around $4,030/oz and $3,960/oz.

Leave a Reply