Why Is Bitcoin Dumping This Week?

Several combined factors triggered the Bitcoin weekly dump and dragged the broader crypto market lower:

1. Global Macro Uncertainty

- Rising global risk aversion and new trade tensions (notably between the U.S. and China) pushed investors toward traditional safe havens like gold and USD.

- Bitcoin, often seen as “digital gold,” behaved like a high-risk tech asset amid macro stress.

2. Leverage & Liquidations

- Excessive leverage in futures markets caused massive long liquidations once BTC broke support near $110K.

- Market makers briefly paused activity, worsening short-term price drops.

3. ETF Outflows & Institutional Selling

- Spot Bitcoin ETFs and major funds, including institutional players, saw billions in outflows this week.

- Rebalancing activity by large asset managers amplified the downside pressure.

4. Sentiment Breakdown & Technical Weakness

- The Crypto Fear & Greed Index dipped deep into “Fear” territory.

- Key technical supports failed, triggering automated sell orders and further liquidations.

On-Chain Data: Signs of Strength Beneath the Drop

Despite the sharp decline, on-chain analytics reveal a different story:

- Exchange reserves remain low, meaning investors aren’t rushing to sell.

- Long-term holders are staying firm, suggesting confidence in BTC’s long-term outlook.

- This correction looks more like a healthy reset after months of gains, rather than panic selling.

Bitcoin Technical Outlook

| Metric | Level |

|---|---|

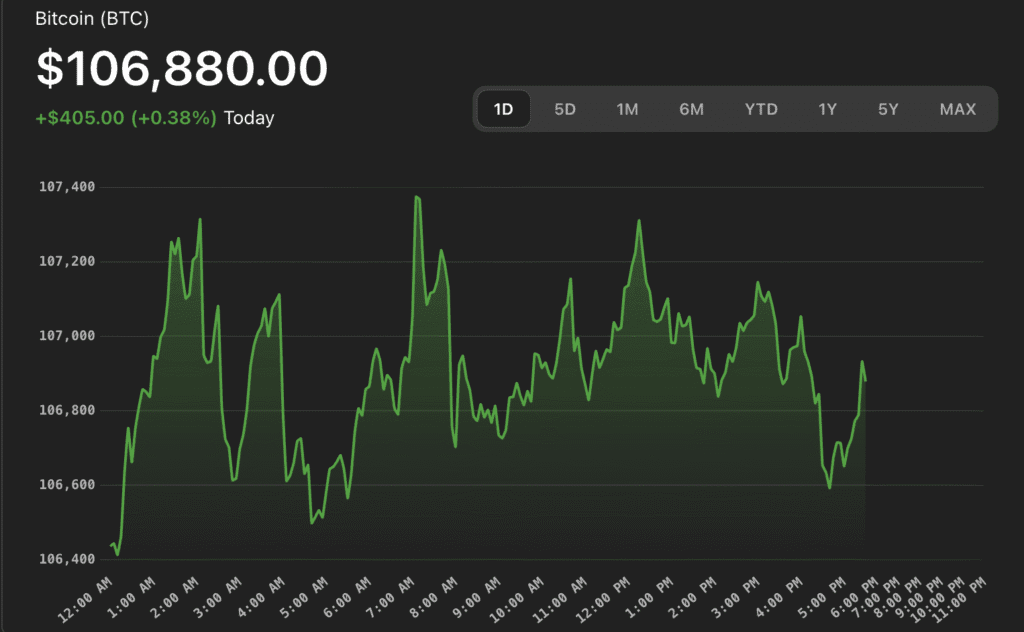

| Current Price (BTC/USD) | ~$106,880 |

| Major Support | $100,000 – $105,000 |

| Key Resistance | $110,000 – $115,000 |

| Sentiment Index | 32 (Fear) |

| Weekly Change | –7.9% |

If Bitcoin holds above $105K, a rebound toward $110K–$112K is likely in the coming days.

However, a break below $100K could trigger another round of liquidations and ETF sell pressure.

What to Watch Next Week

- ETF Flows: Positive inflows could stabilize BTC above $107K.

- Macro Events: U.S. inflation data and interest rate expectations remain key drivers.

- Altcoin Correlation: Ethereum (ETH) and Solana (SOL) mirrored the drop — continued weakness could signal further downside risk.

- Exchange Activity: Rising BTC balances on exchanges could indicate more selling pressure ahead

- Resources : https://cryptopotato.com/no-capitulation-just-consolidation-what-this-bitcoin-btc-correction-really-signals/?utm_source=chatgpt.com

Leave a Reply